The mentha oil rate has become a hot topic among traders, farmers, and investors in recent years. This essential oil, derived from mint leaves, plays a crucial role in various industries such as pharmaceuticals, cosmetics, and food flavoring. Its volatile price trends make it a lucrative but risky commodity in the market. In this blog post, we’ll dive deep into everything you need to know about mentha oil, including its pricing, influencing factors, and how to stay updated with its rates.

What Is Mentha Oil and Why Is It Important?

Mentha oil is extracted from the leaves of the mint plant through a steam distillation process. Known for its cooling properties and strong aroma, it is widely used in products like toothpaste, chewing gum, balms, perfumes, and even medicines. The global demand for mentha oil stems from its versatility and effectiveness, making it a staple in multiple industries.

India is the largest producer of mentha oil, with Uttar Pradesh leading the production. This dominance makes the mentha oil rate in India a key indicator for global markets.

How Is the Mentha Oil Rate Determined?

Understanding what drives the mentha oil rate is essential for anyone looking to trade or invest in this commodity. Here are the primary factors that influence its pricing:

1. Supply and Demand Dynamics

The classic rule of supply and demand significantly affects the mentha oil rate. During peak harvest seasons, the supply is high, often leading to lower prices. Conversely, during off-seasons or periods of low production, prices tend to rise due to limited availability.

2. Weather Conditions

Weather plays a pivotal role in the cultivation of mint plants. Unfavorable weather conditions like excessive rain or drought can hinder crop production, reducing supply and pushing prices upward.

3. Global Market Trends

As a globally traded commodity, the mentha oil rate is also impacted by international market trends. Changes in demand from countries like the United States, China, and Germany, which are major importers, can cause significant price fluctuations.

4. Government Policies

Government interventions, such as export restrictions or subsidies, can directly influence mentha oil prices. Policies aimed at supporting farmers or controlling inflation may alter the market dynamics.

5. Speculative Trading

Like any other commodity, speculative trading in the futures market also affects the mentha oil rate. Traders betting on future price movements can create short-term volatility.

Recent Trends in Mentha Oil Prices

In recent years, the mentha oil market has seen considerable fluctuations. Let’s analyze the most notable trends:

- Post-COVID Recovery: The pandemic disrupted supply chains globally, causing a dip in mentha oil production and a subsequent rise in prices. As industries resumed operations, the demand surged, stabilizing the rates.

- Increased Demand for Natural Products: With a growing preference for organic and natural products, the demand for mentha oil in the pharmaceutical and cosmetics sectors has increased, leading to higher prices.

- Technological Advancements in Farming: Farmers adopting advanced farming techniques have improved yields, slightly stabilizing the supply and, in turn, the rates.

How to Stay Updated on the Mentha Oil Rate

Given the dynamic nature of mentha oil pricing, staying informed is crucial for traders and stakeholders. Here are some practical tips:

1. Monitor Online Trading Platforms

Websites like MCX (Multi Commodity Exchange) provide real-time updates on the mentha oil rate. Traders can track daily price movements and make informed decisions.

2. Follow Industry News

Stay updated with industry news and reports that highlight factors impacting mentha oil prices, such as weather conditions and global demand.

3. Join Farmer Cooperatives

For farmers, being part of cooperatives can provide insights into market trends and collective bargaining power to negotiate better rates.

4. Use Mobile Apps

Several mobile apps are designed to track commodity prices, including mentha oil. These apps provide alerts and forecasts, helping users stay ahead in the market.

How Can Farmers Maximize Profits Despite Fluctuations?

![Mint Oil Prices – Historical Graph [Realtime Updates]](https://procurementtactics.com/wp-content/uploads/2023/11/Mentha-Oil-Prices-2.jpg)

For farmers, fluctuating mentha oil rates can be both a blessing and a curse. Here are some strategies to maximize profits:

1. Diversify Crops

Relying solely on mint farming can be risky. Diversifying crops can ensure a steady income even if mentha oil prices drop.

2. Invest in Storage Facilities

During periods of low prices, farmers can store mentha oil and sell it when the rates are higher. This requires proper storage facilities to maintain oil quality.

3. Collaborate with Buyers

Forming direct partnerships with buyers or exporting directly can eliminate middlemen, ensuring better profit margins.

4. Leverage Government Schemes

Governments often introduce schemes and subsidies for farmers. Staying informed about these opportunities can provide financial relief during challenging times.

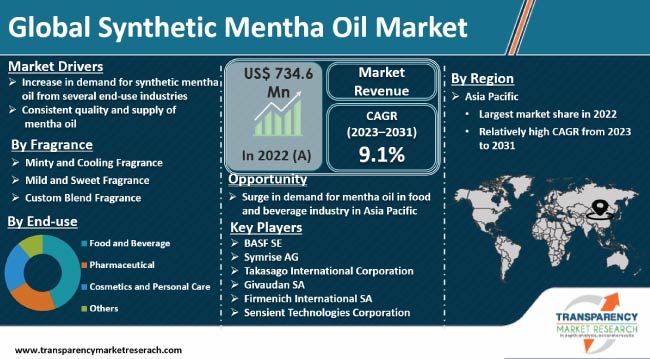

The Future of Mentha Oil Market

The mentha oil market holds significant growth potential. With increasing applications in industries like aromatherapy and organic personal care, the demand is expected to rise steadily. However, sustainability and environmental concerns are likely to shape the future of mentha farming. Adopting eco-friendly farming practices could become a necessity rather than an option.

Final Thoughts

The mentha oil rate is influenced by a multitude of factors, from weather conditions to global demand. Understanding these dynamics can help traders, farmers, and investors make informed decisions. By staying updated and adopting strategic measures, stakeholders can navigate the volatile mentha oil market effectively.