When dealing with banking in India, particularly online transactions, one term that frequently pops up is the SBI IFSC Code. If you’re wondering what it means, why it matters, and how to use it, you’ve come to the right place. This blog post is your ultimate guide to everything you need to know about the SBI IFSC Code and its significance in seamless banking.

What Is an SBI IFSC Code?

The SBI IFSC Code (Indian Financial System Code) is an 11-character alphanumeric code assigned by the Reserve Bank of India (RBI) to uniquely identify every branch of the State Bank of India (SBI). It acts as a critical component in electronic payment systems such as NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and IMPS (Immediate Payment Service). Essentially, it ensures that your money reaches the right SBI branch without errors.

Breaking Down the SBI IFSC Code

To understand the SBI IFSC Code, let’s break it down:

- First four characters: These represent the bank’s code. For SBI, it is always “SBIN”.

- Fifth character: This is always a zero (0) and is reserved for future use.

- Last six characters: These identify the specific SBI branch.

For example, the IFSC Code SBIN0008472 refers to a specific SBI branch in a particular city.

Why Is the SBI IFSC Code Important?

The SBI IFSC Code plays a vital role in ensuring smooth and secure online banking transactions. Here’s why it matters:

- Accuracy in Transactions: It prevents funds from being credited to the wrong account or branch.

- Facilitates Online Payments: It is mandatory for NEFT, RTGS, and IMPS transactions.

- Branch Identification: It uniquely identifies the SBI branch involved in the transaction.

- Efficient Banking: It ensures a faster and more streamlined banking process.

How to Find the SBI IFSC Code?

Locating the SBI IFSC Code is simple and can be done through several methods:

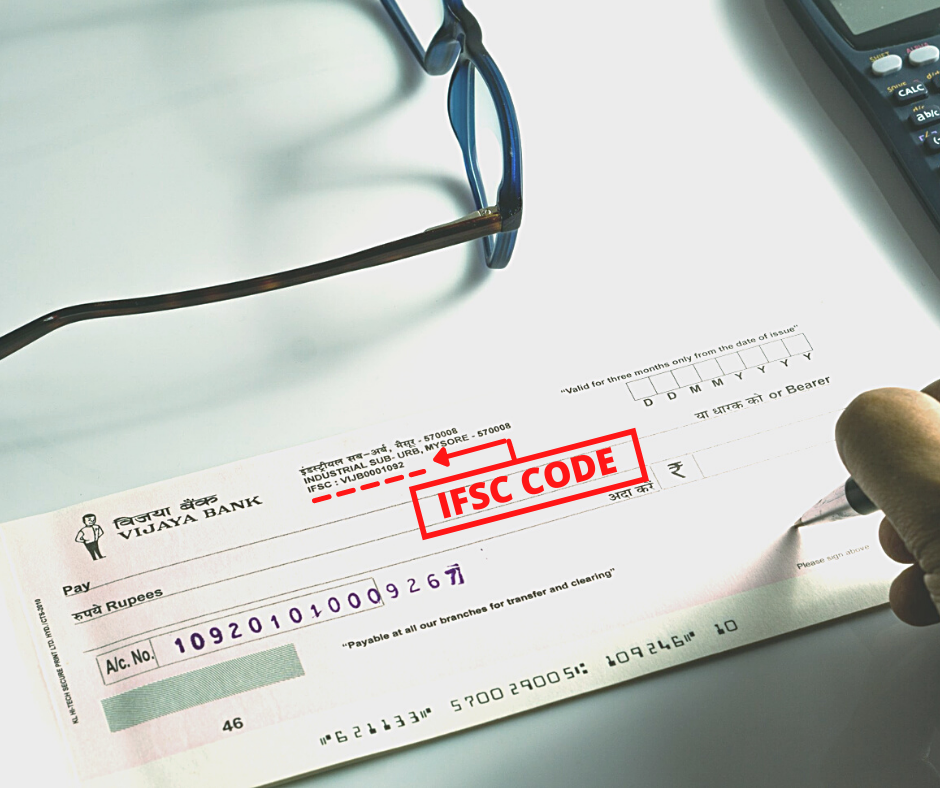

On Your Cheque Book

If you have an SBI cheque book, the IFSC Code is printed on the top left or right corner of every cheque.

Online SBI Portal

Visit the official State Bank of India website and use their branch locator tool. This tool allows you to search for the IFSC Code of any SBI branch.

Mobile Banking Apps

Most banking apps, including SBI’s YONO app, provide easy access to IFSC Codes for various branches.

RBI Website

The Reserve Bank of India’s official website maintains a list of all IFSC Codes for banks in India, including SBI.

Customer Care

You can always contact SBI customer service, and they will provide you with the required IFSC Code.

How to Use the SBI IFSC Code for Transactions?

Using the SBI IFSC Code is straightforward. Here’s how you can use it for various online banking transactions:

NEFT Transactions

When transferring funds via NEFT, you’ll need to:

- Enter the recipient’s name and account number.

- Provide the SBI IFSC Code of the recipient’s branch.

RTGS Transactions

RTGS transactions require:

- Recipient’s account details.

- The accurate SBI IFSC Code.

IMPS Transactions

IMPS allows instant transfers, and you’ll need the recipient’s:

- Mobile number or account details.

- SBI IFSC Code for branch-based transfers.

Common Errors to Avoid

Even though the SBI IFSC Code simplifies transactions, errors can still occur. Avoid these common mistakes:

- Incorrect IFSC Code: Double-check the code before initiating any transaction.

- Mismatch in Account Details: Ensure that the account holder’s name matches the account number and IFSC Code.

- Outdated Codes: Occasionally, bank branches merge or relocate, leading to changes in IFSC Codes. Verify the code regularly.

Benefits of Knowing Your SBI IFSC Code

Understanding and using the SBI IFSC Code comes with multiple advantages:

- Security: Minimizes the risk of errors during fund transfers.

- Convenience: Enables hassle-free online banking.

- Global Transactions: Facilitates international wire transfers through corresponding IFSC Codes.

FAQs About SBI IFSC Code

What Happens if I Use the Wrong IFSC Code?

If the IFSC Code is incorrect, the transaction will typically fail, and the money will be refunded to your account. However, double-check all details to avoid delays.

Are IFSC Codes Confidential?

No, IFSC Codes are not confidential. They are publicly available and meant to facilitate banking transactions.

Can Two Branches Have the Same IFSC Code?

No, each SBI branch has a unique IFSC Code to ensure accurate identification.

Do IFSC Codes Change?

Yes, IFSC Codes can change due to branch mergers, relocations, or policy changes by the RBI. Always verify the current code.

Fun Facts About SBI IFSC Code

Did you know?

- SBI is one of the largest banks in India, with over 22,000 branches. That means over 22,000 unique IFSC Codes!

- The IFSC Code system was introduced to simplify India’s growing online banking infrastructure.

Conclusion

The SBI IFSC Code is much more than just an alphanumeric string. It’s a gateway to secure, swift, and efficient banking. Whether you’re paying for groceries, sending money to a friend, or handling a business transaction, understanding the SBI IFSC Code ensures that your funds reach the right place every time.

So, next time you’re completing a transaction, take a moment to appreciate the role of this tiny yet mighty code in keeping your banking smooth and stress-free. Happy banking!